Personal Finance Simplified with Powerful Tools

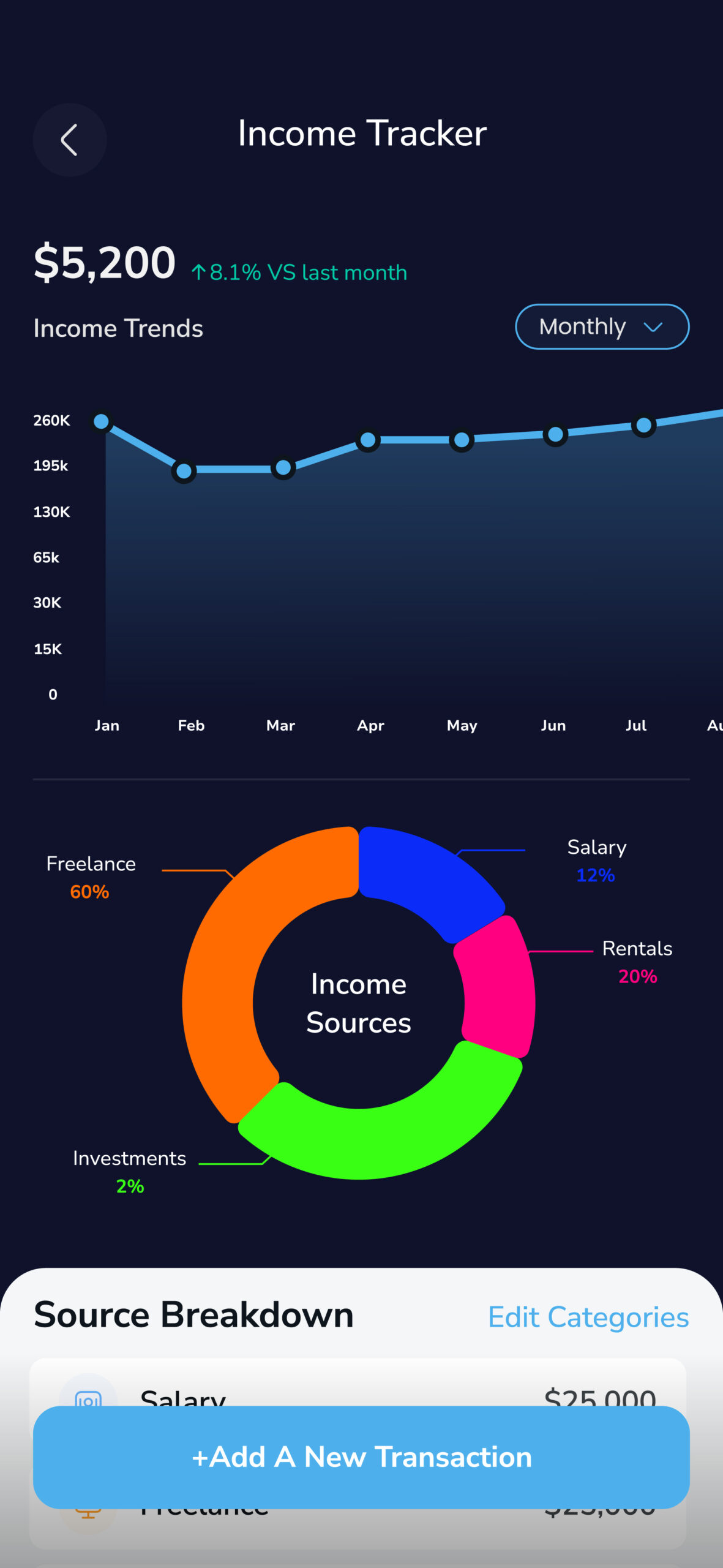

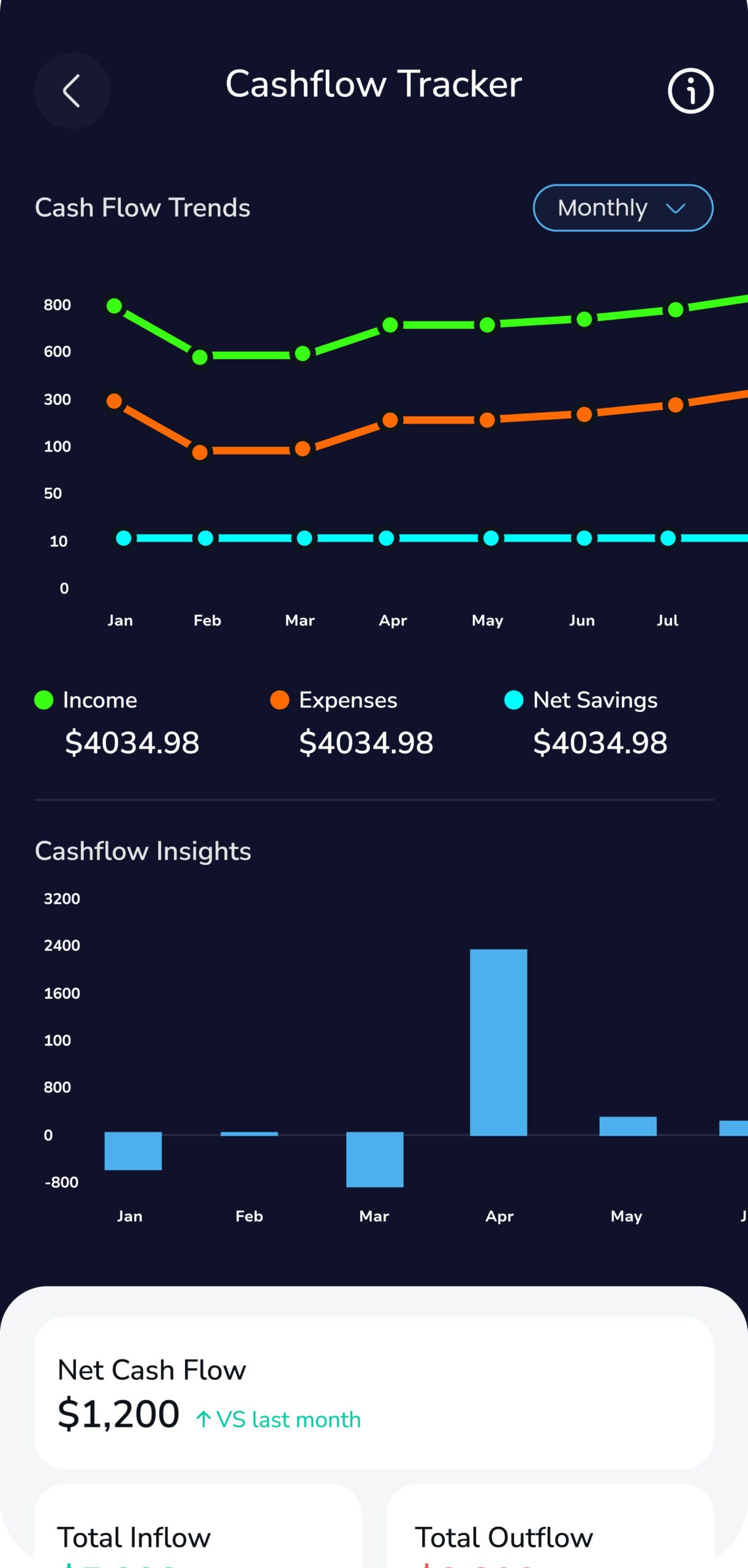

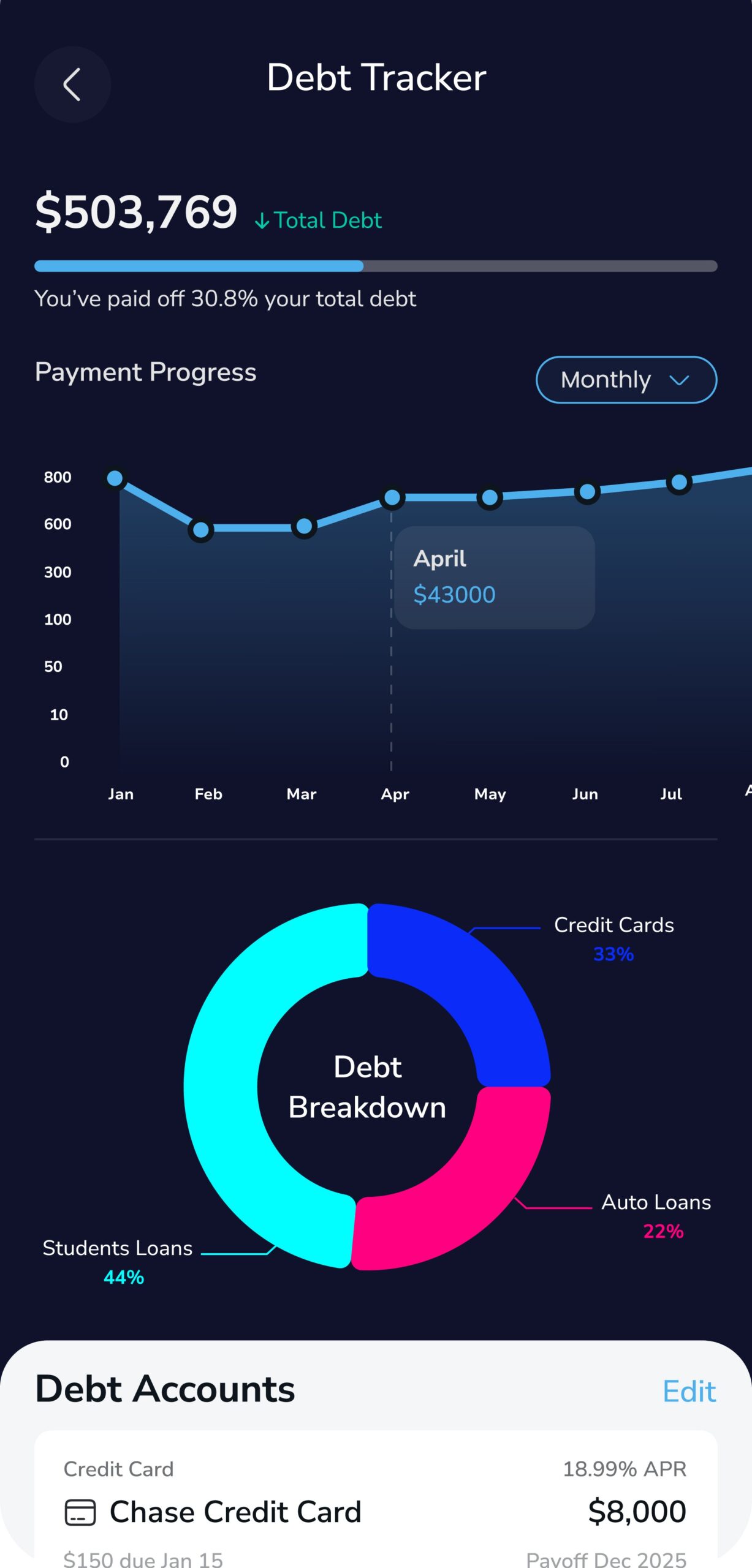

Take control of your money with intuitive features designed to make personal finances effortless. Track your income and expenses in real time, set and manage budgets with ease, and keep all your accounts in one place with seamless consolidation.

Track all your finances in one place—investments, loans, expenses, income, savings, credit score, cash flow and more. Get real-time updates, clear insights, and a complete view of your financial health, so you always stay in control.

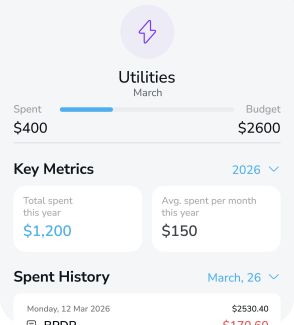

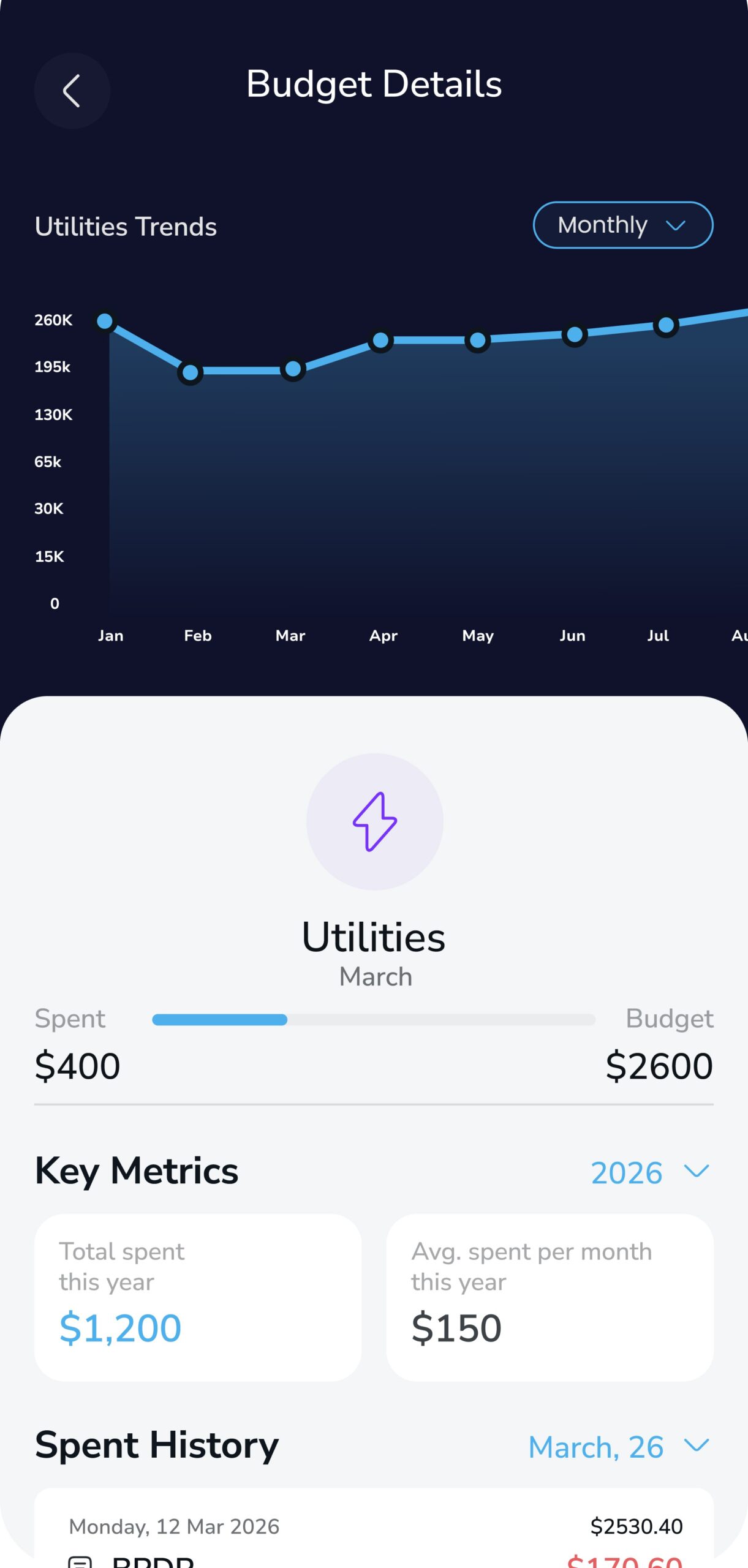

Easily create and manage budgets that fit your lifestyle. Track spending, set limits, and adjust in real time to stay on top of your personal finance goals. Gain insights to make smarter decisions and take control of your money with confidence.

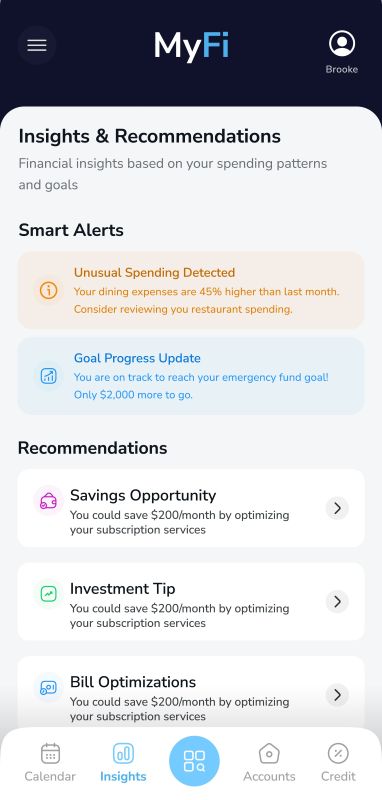

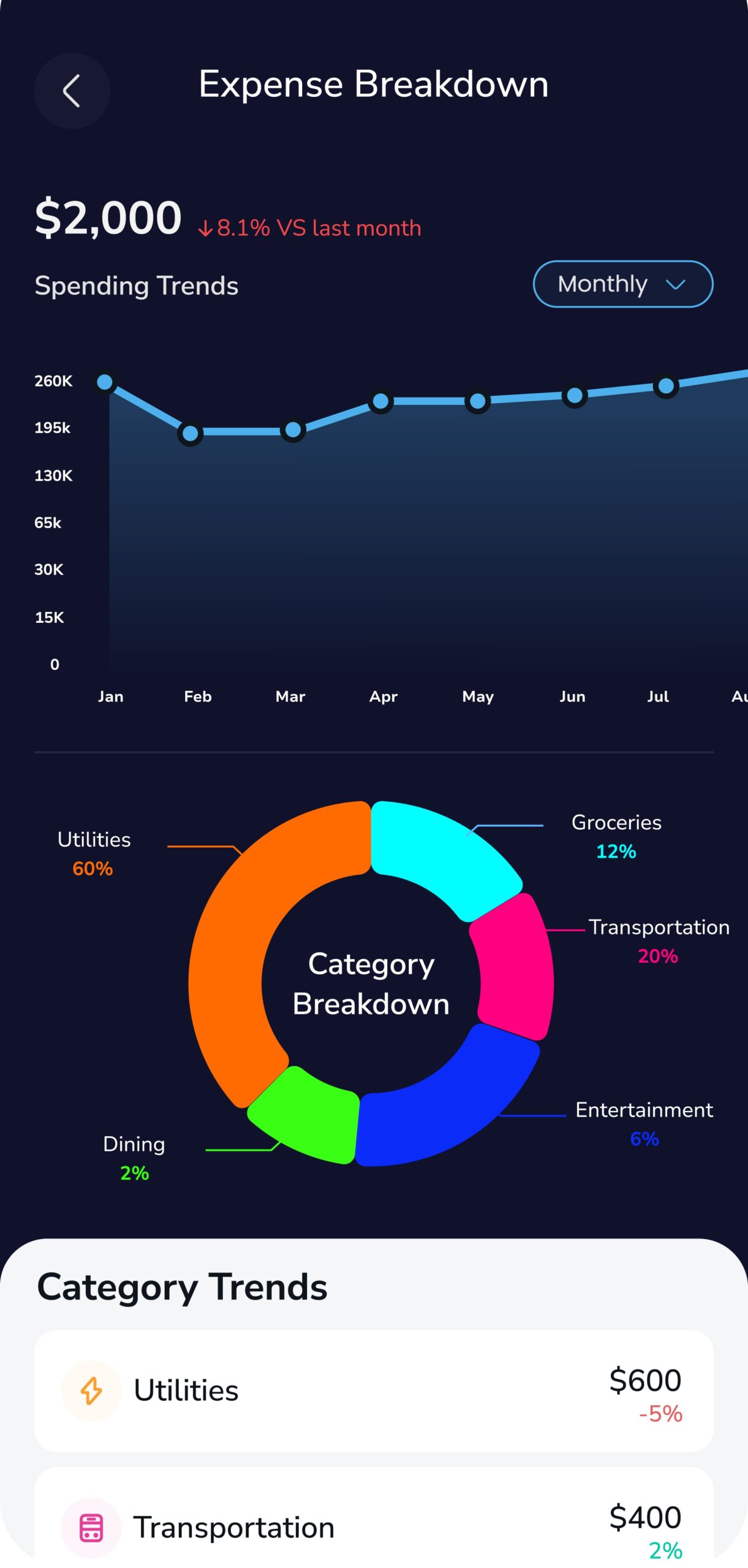

Gain deeper insights into your personal finances with real-time analytics. Track spending patterns, monitor trends, and get personalized reports to make smarter money decisions. With clear, data-driven insights, you’ll always know where your money is going and how to optimize it.

See your entire financial picture in one view. Connect your checking, savings, credit cards, investments, loans, and even property accounts for a complete, real-time snapshot of your net worth. No more switching between apps—everything you need for your personal finances in one place.

Designed For Simplicity

From tracking expenses to detailed budgeting, every feature is designed for ease of use—so you can focus on your personal finances without the hassle.

Your All-in-One Credit Score Tool

Take control of your financial future with our powerful credit management features, designed to help you monitor, understand, and improve your credit with ease. Whether you're looking to boost your score, track changes, or get expert guidance, our tools give you everything you need to stay on top of your financial health.

Credit Score

Get instant access to your latest credit score and track changes over time.

Monitoring

Stay protected with real-time alerts on any changes to your credit profile.

Reports

View detailed credit reports from to understand what’s impacting your score.

Credit Coach

Use our Credit Coach to see what actions you can take to reach your desired score.

Frequently Asked Questions

What is MyFi, and how does it work?

MyFi is a modern financial app that helps you track your money, manage budgets, monitor your credit score, and more. It consolidates all your accounts in one place, giving you a clear picture of your financial health.

Is MyFi free to use?

Yes! You can download MyFi for free and access core features like financial tracking, budgeting, and account consolidation. Some premium features, such as advanced analytics and credit score tracking require a subscription.

Can I track investments?

Yes, MyFi allows users to track investment accounts performance all in one view.

Is MyFi safe and secure?

Absolutely, MyFi is safe and secure — we use the latest encryption and security protocols to protect your data and ensure your information stays private.

Can I use MyFi if I do not have a banking account?

Yes! MyFi offers manual input to track cash and investments like collectibles and land.

Latest News From Us

Stay in the know! Read the latest news from our blog

for up-to-date information on MyFi and our industry.

Join the MyFi Community and See How You Can Get Involved Before Launch

Beta Testing & Early Access: Be the First to Try MyFi!

Subscribe to Newsletter

Submit your email address and start receiving updates on MyFi.